FinTech In Singapore Marketing Playbook

Introduction

1.1. The Singapore FinTech Market: A Data-Driven Snapshot

The Singaporean FinTech market is a high-growth, high-competition battleground. The Digital Payments segment, the largest within FinTech, is projected to handle a transaction volume of over USD $23 billion in 2024. The Neobanking segment, your direct area of operation, is expected to grow from ~400,000 users in 2024 to over 1 million by 2029.

The landscape is heavily influenced by the Monetary Authority of Singapore (MAS), which fosters innovation while ensuring stringent regulation. The government’s push for a digital economy, exemplified by nationwide adoption of services like PayNow, creates a fertile ground for FinTech solutions. Furthermore, Singapore’s 586,000+ SMEs form the backbone of the economy, yet are historically underserved by traditional banks. This is the gap your platform must aggressively target.

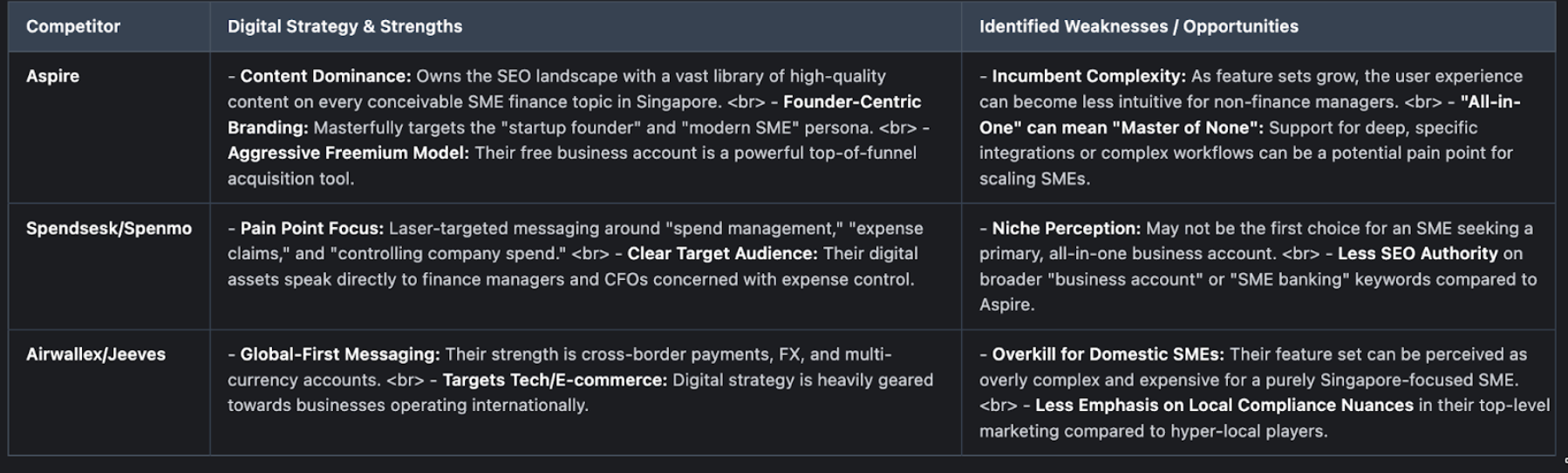

1.2. Competitor Deconstruction: Aspire, Spendsesk, Airwallex

A surgical analysis of the primary competitors reveals their playbooks, which we will counter and exploit.

Your Strategic Opening: The market has been educated by Aspire on the “all-in-one” concept. Your opportunity is not to re-educate, but to out-execute on usability and integration. Your messaging must be: “The power of an all-in-one financial OS, but designed to be beautifully simple and seamlessly connected to the Singaporean business ecosystem.”

1.3. Audience Insights: The Singaporean SME Founder & Finance Manager

Your target user is a busy decision-maker whose primary goals are growth and efficiency. Their core financial pain points are:

- Fragmented Financial View: Juggling multiple platforms—traditional bank accounts, credit card portals, expense apps, and accounting software—leads to a lack of real-time cash flow visibility.

- Time-Consuming Manual Work: Manually paying invoices, chasing receipts for expense claims, and reconciling transactions are significant productivity drains.

- Lack of Control & Visibility: Inability to easily set and enforce spending limits on corporate cards, leading to budget overruns.

- Poor Banking User Experience: Frustration with the clunky, slow, and non-intuitive interfaces of traditional corporate banking portals.

- Integration Hell: Wasting time manually exporting/importing data between their bank and accounting software like Xero.

Your marketing must speak directly to these frustrations, promising control, time-savings, and clarity.

Website Strategy

Your website must be a meticulously engineered tool for converting visitors into sign-ups or demo requests. It must immediately establish trust and differentiate you from the noise.

2.1. Practical Recommendations for a High-Conversion Website

- UVP-Driven Homepage: The hero section must instantly communicate your value.

- Headline: The Financial OS for Singapore SMEs. Finally Made Simple.

- Sub-headline: Get a multi-currency business account, smart corporate cards, and automated bill payments in one place. Onboard in minutes, not weeks.

- Primary CTA: Open a Free Account / Get Started

- Visual: A clean, animated GIF or short video showcasing the seamless flow of your dashboard.

- Build Unshakeable Trust (MAS Compliance is Key):

- Display Licensing Information Prominently: Your MAS license (e.g., Major Payment Institution) is your most important trust signal. Display “Licensed by the Monetary Authority of Singapore” with your license number in the footer of every page.

- Social Proof: Use logos of well-known Singaporean SMEs who are your clients. Feature specific, problem-solving testimonials: “We switched from [Traditional Bank/Aspire] to [Your Company] and the user interface is night and day. We now save 10+ hours a month on reconciliation.”

- Partner Logos: Prominently display “Connects with Xero” and other accounting software logos.

- Solution-Led Product Pages: Structure pages around the jobs-to-be-done.

- “Business Account” -> “A Business Account Built for Growth”

- “Corporate Cards” -> “Control Company Spending with Smart Cards”

- “Bill Pay” -> “Automate Your Accounts Payable”

- Each page must highlight ease of use, time saved, and integration benefits.

- Direct Competitor Comparison Page: Create a page titled “[Your Company] vs. Aspire.” Control the narrative. Use a feature comparison table that highlights your strengths (e.g., UI/UX rating, onboarding time, specific integration features, customer support rating). This captures high-intent search traffic.

2.2. Proposed Sitemap

- /homepage

- /business-account

- /corporate-cards

- /accounts-payable

- /integrations

- /pricing

- /customers (Case Studies & Testimonials)

- /resources (Blog)

- /contact-us

- /sign-up

2.3. Wireframe Component: Homepage – “How We Solve Your Problems” Section

- Component: Problem/Solution Section (Below Hero)

- Layout: Three-column layout.

- Column 1:

- Icon: Clock

- Headline: End Manual Reconciliation

- Text: Connect seamlessly with Xero to automate transaction matching. Cut your month-end closing time in half.

- Column 2:

- Icon: Credit Card with Shield

- Headline: Eliminate Rogue Spending

- Text: Issue physical and virtual corporate cards with customisable limits and controls. Get real-time visibility on all team expenses.

- Column 3:

- Icon: Globe

- Headline: Pay Bills, Not Bank Fees

- Text: Automate local and international payments with transparent, low-cost FX rates from your multi-currency account.

Search Engine Optimization (SEO) Strategy

Your goal is to intercept SMEs searching for solutions to their financial frustrations. SEO is how you do it at scale.

3.1. Keyword Analysis: Singaporean FinTech Search Intent

Target keywords across the buying funnel:

Commercial Intent Keywords (High Priority):

- Primary Targets: “sme business account singapore”, “corporate card for startups sg”, “multi currency account singapore”, “aspire alternative”, “airwallex vs aspire”.

- Long-Tail Targets: “best business account for small business singapore”, “how to pay international invoices from singapore”, “xero integration business account sg”.

Informational Intent Keywords (For Authority Building):

- Problem-Focused: “how to manage business cash flow”, “ways to reduce company expenses”, “what is accounts payable automation”.

- Compliance/Localisation-Focused: “guide to corporate tax in singapore”, “understanding paynow for business”, “singapore invoicing requirements”.

3.2. Strategic Content Recommendations

Aspire’s playbook is content-heavy; you must compete here.

- Pillar Content: Create flagship guides that serve as definitive resources.

- “The Singapore SME’s Guide to Financial Operations”: A comprehensive guide covering everything from opening an account to managing FX and closing the books. A powerful lead magnet.

- “SaaS & E-commerce Accounting in Singapore”: A niche guide targeting high-value tech SMEs.

- Tactical Blog Posts:

- Comparison Posts: “[Your Company] vs. Traditional Banks: A Feature-by-Feature Breakdown.”

- Problem/Solution Posts: “5 Signs Your SME Has Outgrown its Bank Account,” “How to Cut International Transfer Fees by 70%.”

- How-To Guides: “How to Set Up PayNow for Your Business,” “How to Reconcile Corporate Card Transactions in Xero.”

3.3. Backlink Strategy: Building Credibility

- FinTech & Startup Media: Target features or guest posts on sites like Tech in Asia, e27, Vulcan Post, and Singapore FinTech News.

- VC & Accelerator Networks: If you are venture-backed, leverage your investors’ network for introductions and features on their websites.

- Partner Co-Marketing: Create joint webinars or guides with your accounting software partners (like Xero). This is a powerful way to get in front of their audience and earn a high-quality backlink.

Paid Advertising Strategy

PPC delivers immediate, targeted traffic and leads. Your campaigns must be granular and ROI-focused.

4.1. Google Ads Framework

- Campaign Structure:

- Campaign 1: Brand Search: Protect your brand name.

- Campaign 2: Competitor Search: Aggressively target “Aspire”, “Spendsesk”, “Airwallex” keywords. Ad copy must highlight your UVP (e.g., “Tired of Aspire’s UI? Try a Simpler Alternative”).

- Campaign 3: Solutions – Business Account: Target keywords around “business account for sme”.

- Campaign 4: Solutions – Spend Management: Target “corporate card” and “expense management” keywords.

- Campaign 5: Retargeting: Show ads to past website visitors.

- Example Ad (for “sme business account singapore”):

- Headline 1: The Modern SME Business Account

- Headline 2: MAS Licensed & Xero Integrated

- Headline 3: Fast Online Onboarding

- Description: Stop wrestling with traditional banks. Get corporate cards, bill pay, and multi-currency accounts in one simple platform. Open your free account today.

4.2. LinkedIn Ads Strategy

This is your primary channel for precision targeting.

- Targeting: Location (Singapore) + Company Size (10-250 employees) + Job Titles (Founder, CEO, CFO, Finance Manager) OR Job Function (Finance, Operations).

- Campaigns:

- Lead Generation: Promote your pillar content (e.g., Financial Operations Guide) using LinkedIn Lead Gen Forms for frictionless lead capture.

- Website Traffic: Drive targeted users to your competitor comparison pages.

- Retargeting: Show demo request ads to website visitors who match your target audience criteria.

Social Media Strategy

- Primary Platform: LinkedIn. This is your stage. Your Company Page must be a resource, not a sales pitch.

- Content Strategy: Share insights on SME finance, repost relevant articles from reputable sources (The Business Times, MAS) with your commentary, and celebrate customer milestones.

- Founder/CEO Presence: Your leadership team should be active on LinkedIn, building their personal brands as experts in SME finance.

Video Marketing Strategy

- Video Content:

- Product Walkthroughs (90 secs): Create short videos showing exactly how easy it is to perform a key task (e.g., “Pay 10 Invoices in 60 Seconds,” “Issue a Virtual Card in 3 Clicks”).

- Customer Testimonials (60 secs): A Singaporean founder explaining how you saved them time is your most potent marketing asset.

- Animated Explainers (60 secs): Simplify concepts like “What are Interbank FX Rates?” to build authority and trust.

Performance Measurement & KPIs

Track metrics that translate to revenue.

- Core KPIs:

- Number of New Account Sign-ups / Demo Requests.

- Cost Per Acquisition (CPA): How much it costs to get one qualified sign-up.

- Activation Rate: The percentage of sign-ups that become active, transacting users.

- Lead-to-Customer Conversion Rate.

- Dashboard: Use a tool like Looker Studio to create a unified dashboard. It must track your funnel from ad click -> website visit -> sign-up -> activation.

Conclusion

The Singapore fintech industry presents significant opportunities for operators who strategically leverage digital marketing capabilities and emerging technologies. While the market remains competitive, substantial gaps in current digital marketing practices create immediate opportunities for differentiation.

By implementing the recommendations outlined in this playbook, fintech can enhance visibility, improve conversion rates, and establish a sustainable competitive advantage. The integration of AI-powered solutions represents a particularly promising frontier, enabling centres to deliver personalized experiences at scale while optimizing operational efficiency.

Executing this playbook requires discipline and a focus on the customer. Your competitive advantage is not just having a better product, but more effectively communicating its simplicity and value to a market tired of complexity.

Claim your FREE 90-Day

Marketing Action Plan for

FinTech in Singapore

This is for fintech in Singapore looking to grow—

book a no-obligation call to get your action plan and discuss your business!